Financial Planning

built with

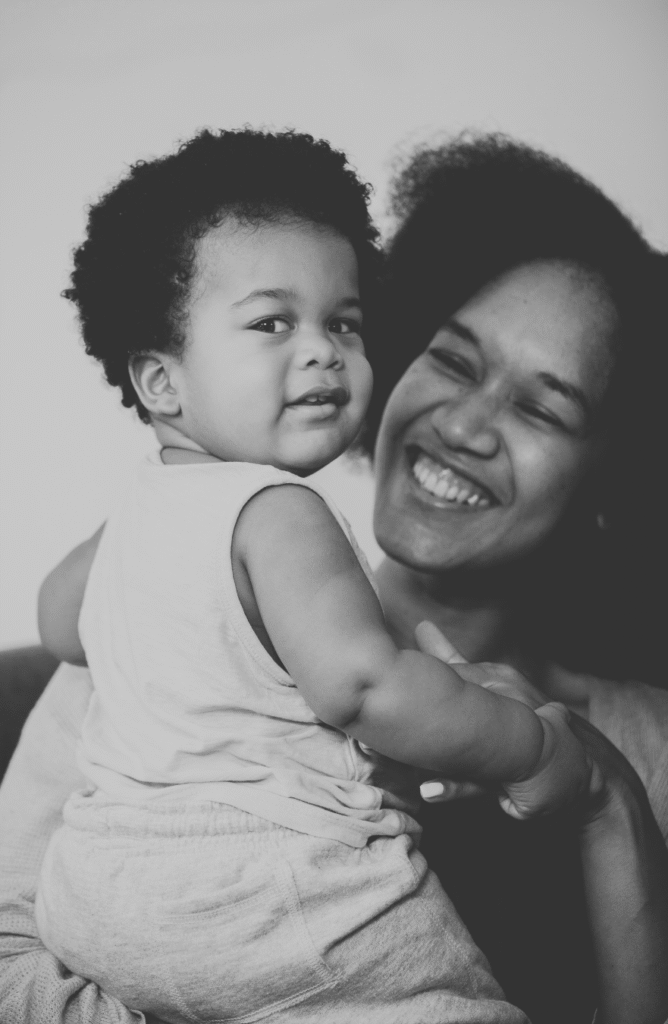

Who

We work with ambitious women, busy mums, and female founders.

What

A clear, jargon free plan with actionable steps to secure your family, grow your finances, and achieve your goals.

Why

Ivey has been built to give women the control and calm they deserve.

built by women for women

Why we’re here

We believe knowledge and access are our greatest assets for challenging the status quo, taking control and putting money in the pockets of women.

Building wealth

Ivey puts women at the center — not as an afterthought and not as a marketing exercise.

Whatever stage you’re at we’re here to get you focused, and financially free.

Developing financial literacy

Empowerment only lasts if understanding is part of the journey. That’s why we focus on building true financial literacy.

of wealth set to be in the hands of women by 2025

The Centre for Economics and Business Research

more in mens pensions on average

Women’s Budget group

drop in earnings after birth of first baby (over first 5 years)

Office for National Statistics (ONS)

Do you see yourself?

Who we help

The Female Founder

Female Founders Growing with Intention

Combining personal and business planning

The Busy Mum

Mums Wanting Calm, Clarity & Security

Planning for maternity leave, childcare costs, and your child’s future

The Career Woman

Ambitious Women Climbing the Ladder

Balancing high earnings and employee benefits

The Women in Transition

Women Navigating Life’s Big Changes

Divorce, grief, marriage, and everything in between

and many more

How it works

What Working Together Looks Like

1.

Discover

Understand where you are now

Read more

We begin with a short call (up to 30 mins) to check we’re aligned. It matters that we get on — financial advice isn’t a one-off transaction. I’ll be by your side through the biggest milestones, often for years.

After the call, you’ll receive a simple pack to complete so I can get a clear snapshot of your current situation. This includes a fact find, a risk questionnaire, your service and fee agreement, and your invoice.

Your job is to share the basics. My job is to make this feel easy, clear and judgment-free.

2.

Define

Understand where you want to be

Read more

Once everything is returned and your invoice is settled, we move into stage two.

We’ll book a longer conversation (around an hour) to explore your goals, your ambitions, what drives you, your relationship with money, and what “security” and “success” truly mean to you.

This stage is about you, not your accounts. It’s how we make sure your plan works with your real life — not against it.

3.

Design

We research and build your roadmap

Read more

Now you can hand the reins over.

I gather everything from stage one and two, contact any existing plan providers, analyse your current position and begin building your personalised plan.

This includes the steps you need to take, the timelines, the opportunities, the risks to be aware of, and the most efficient route to your future goals.

You rest — I get to work.

4.

Deliver

Turning your plan into action

Read more

Once your full plan is ready, we’ll meet again (about an hour again) to go through it in detail.

Together we’ll confirm your “now,” map out your “future,” walk through every actionable step clearly and calmly, review your cash-flow model, answer questions and make tweaks.

My job is only done when you feel confident, clear, and fully understand both what to do and why.

Once agreed, I support you by implementing the actions so progress actually happens — not just sits on a to-do list.

5.

Develop

Keeping your plan alive and aligned

Read more

Life shifts. Careers evolve. Children grow. Priorities change.

Your financial plan needs to move with you.

That’s why I offer ongoing support, including optional monthly Quick Dips — short 15-minute sessions focused on coaching, clarity, and keeping you on track. It’s a space to stay calm, focused, and free from the constant mental load of “I really should sort my finances…”

Whether or not you use the monthly coaching, we’ll meet once a year for your Deep Dive.

This is our chance to review your whole plan, repeat key parts of the process, prepare for any upcoming changes, adjust the route as needed, and check everything still reflects your life, values and goals.

🎉

Community

Celebrate and share your wins

Read more

This isn’t just advice; it’s a long-term partnership. And I love celebrating your wins and progress with you.

With consent we share our clients wins via our Client Stories page.

We also hold exclusive clients events so you can build not only your professional network of likeminded ambitious women, but also your village of mothers and founders.

Our support doesn’t end at topping up a pension or transferring an ISA. We’re here to help you GROW.

Services

What do we do?

Remove confusion around pensions

Reassure you can afford the big life choice

Navigate investing for your future

Protect your family and your business

Bring calm to the chaos

Is that all? Not even close.

Visit our Services page for full details.

Financial planning that puts women first — with clarity, respect & uncompromising quality.

My values center on closing the wealth gap by giving women the knowledge, support and professional network they need — at every stage of life, career or motherhood.

This is about raising standards, expanding access, and making sure women are never left out of the financial conversation again.

Testimonials & Reviews

Some Love From Clients

Jenny Pink

I got the feeling that the website is trying to tell me something. Do you have the same feeling?

Tommy Blue

The theme is free, so it’s like a treat for me. So the real question will be, will this theme have pro functionality?

Tim Lemons

From the perspective of Virtual Reality – The Lemmony theme is very Virtual. So it was the main point why I chose it.

A goal without a plan is just a wish

Antoine de Saint-Exupéry

For too long finance has been designed by men for men, leaving women out of the conversation.

Take control today

No hard sell, no mansplaining, no minimum investments

What are people asking us?